If you’re like me, you probably have a lot of questions about Payoneer’s virtual card fees. I was curious too—especially after seeing all the mixed info online. So, I decided to dig deeper, test it out, and share my experience with you.

What’s the Deal with Payoneer Virtual Card Fee?

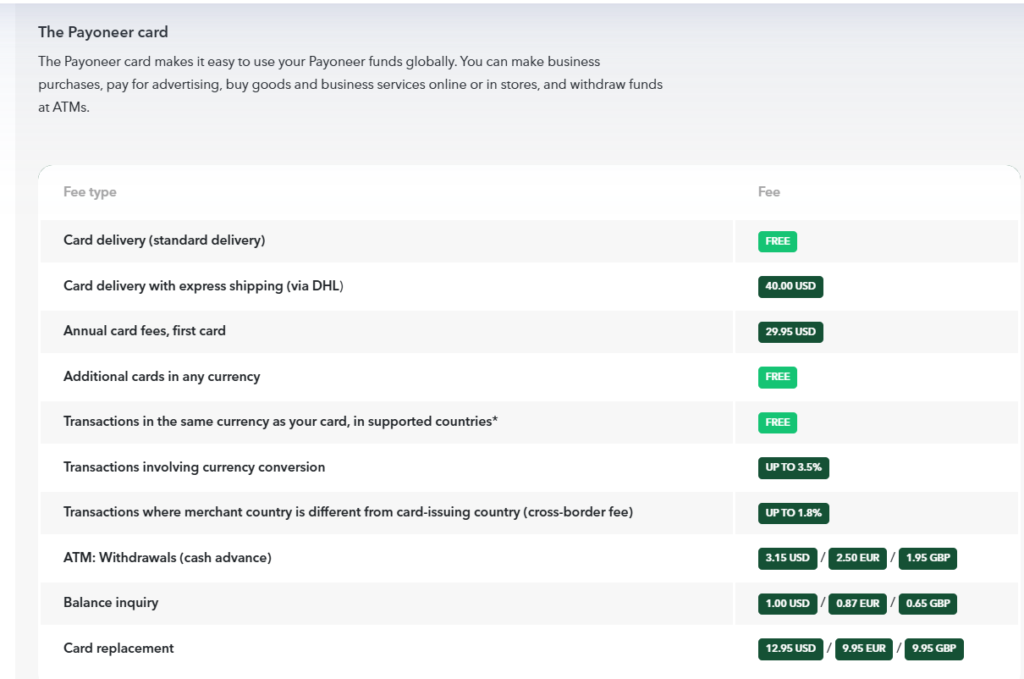

To be honest, when I first looked at Payoneer’s website, I couldn’t find any clear info about the fee for a virtual card. The site mentions a $29/year fee for the physical Mastercard, but nothing about the virtual one. Naturally, I thought it might be free for online shopping. But after a bit of digging and confusion, I found out that yes, the virtual card also comes with a $29 annual fee—just like the physical one.

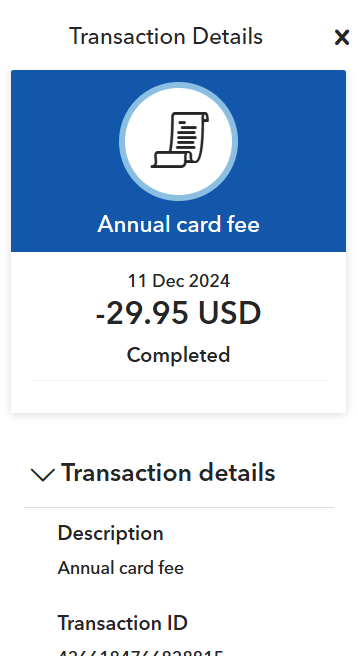

I checked Payoneer’s pricing page and FAQ, but it didn’t explain it clearly. So, I decided to go ahead and get the virtual card anyway. After going through their verification process (including submitting my 3-month bank statement), the fee was charged to my account right at the start—$29.95 for the virtual Mastercard.

So, if you were wondering about this, here’s the short answer: No, it’s not free. Payoneer charges $29.95 per year for both the physical and virtual cards.

Why Did I Still Get the Virtual Card?

Even though the fee was a bit of a surprise, I still went ahead with it. Why? Because Payoneer is a good option for freelancers, especially in countries like Pakistan, where PayPal isn’t available and Payoneer consider as Paypal Alternative. Compared to other services, Payoneer offers lower fees and is a great alternative for receiving payments from international clients.

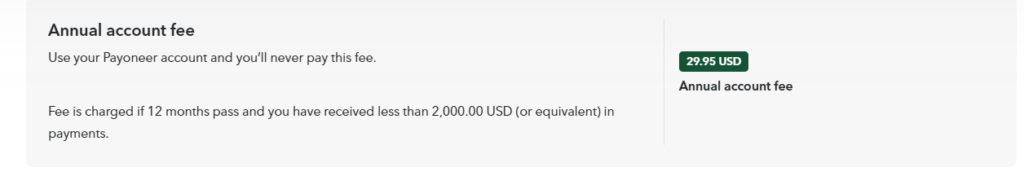

However, things have changed a bit. It seems Payoneer is now focusing more on bigger businesses, and they’re charging more fees for smaller accounts. For example, if your account balance is under $2,000 a year, you’ll also get hit with a $30 annual maintenance fee. That’s another thing to keep in mind.

Is Payoneer Still Worth It for Freelancers?

Yes, Payoneer is still a solid option for many freelancers, but it’s not as cheap as it used to be. If you’re a small freelancer who doesn’t make $2,000 a year or more in transactions, you might want to consider other options. The fees can add up, and with the recent changes, it’s not as freelancer-friendly as it once was.

But if you regularly make larger transactions or work with international clients who prefer Payoneer, the service is still a good choice. The virtual card works well for online shopping, and it’s accepted on most e-commerce sites, just like a regular Mastercard.

Final Thoughts

To wrap up, if you’re asking whether Payoneer’s virtual card is free, the answer is no—it comes with an annual fee of $29. While Payoneer is still a useful tool for freelancers, especially in places where PayPal isn’t available, the rising fees might make it less appealing for smaller users.

If you want more details on their pricing, you can always check Payoneer’s official pricing page here.

Hopefully, this helps clarify things a bit, and if you were on the fence about getting Payoneer’s virtual card, now you know exactly what to expect.

Let me know if you have any other questions—I’m happy to share more of my experience!